| Price Charts, Technical and Fundamental Analysis / Technical Indicators / Oscillators / Stochastic Oscillator |

|

|

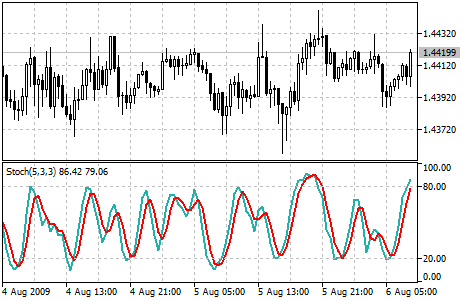

Stochastic Oscillator

The Stochastic Oscillator Technical Indicator compares where a security’s price closed relative to its price range over a given time period. The Stochastic Oscillator is displayed as two lines. The main line is called %K. The second line, called %D, is a Moving Average of %K. The %K line is usually displayed as a solid line and the %D line is usually displayed as a dotted line. There are several ways to interpret a Stochastic Oscillator. Three popular methods include:

You can test the trade signals of this indicator by creating an Expert Advisor in MQL5 Wizard. |

|---|

Calculation

Four variables are used for the calculation of the Stochastic Oscillator:

The formula for %K is:

%K = (CLOSE - MIN (LOW (%K))) / (MAX (HIGH (%K)) - MIN (LOW (%K))) * 100

Where:

CLOSE — today’s closing price;

MIN (LOW (%K)) — the lowest minimum in %K periods;

MAX (HIGH (%K)) — the highest maximum in %K periods.

The %D moving average is calculated according to the formula:

%D = SMA (%K, N)

Where:

N — smoothing period;

SMA — Simple Moving Average.